If you’re interested in taking credit card payments for your small business but not sure where to start, this guide is for you.

Processing credit card payments should be a routine part of business, not a source of stress. We wrote this guide to make it as simple as possible to get you set up for credit card processing.

In this guide:

- What is credit card processing?

- How credit card processing works

- What does credit card processing cost?

- Selecting a credit card processor

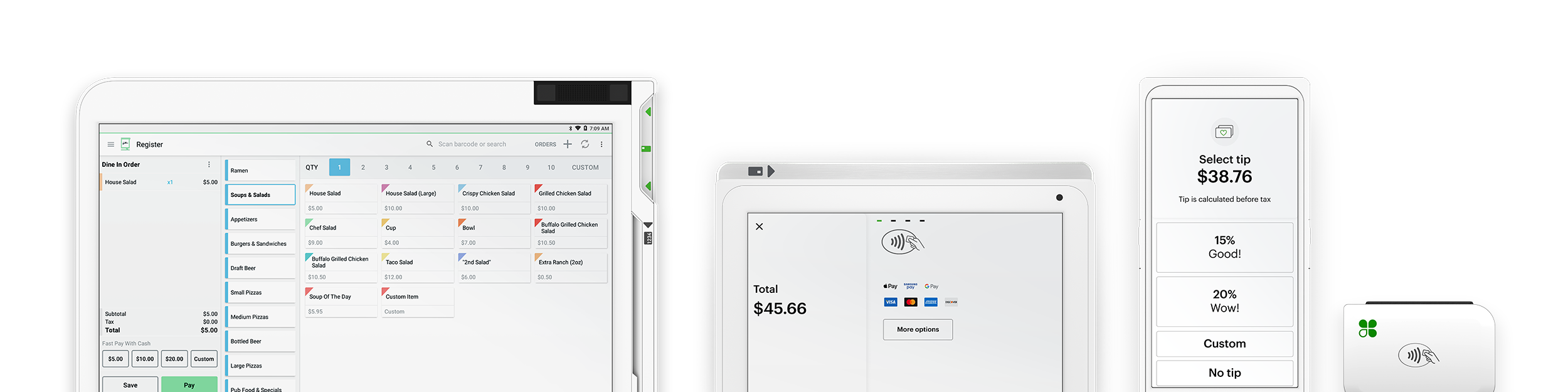

- Selecting a POS system

What is credit card processing?

Credit card processing at a glance

Credit card merchant account processing refers to the series of operations required to complete payments made with a credit card in person, online, over the phone, or by mail.

Who is involved in credit card processing?

The following entities are central to how credit card processing works to securely capture payments at the point of sale (POS).

Consumer. The cardholder, or the person making the purchase.

Merchant. The person or business selling the product or service the consumer is purchasing.

Payment gateway. The technology that connects a merchant to a payment processor. Typically, a gateway integrates with card-present (e.g., in-store purchases) as well as card-not-present (e.g., online or eCommerce) payment environments, captures payment details for customer transactions and routes them to a payment processor or the merchant bank, and sends an “approved” or “declined” message to the merchant.

Credit card processor. Also known more generally as a “payment processor.” The entity that facilitates communication between the merchant, the credit card network, and the cardholder’s bank. Processors, along with merchants, are responsible for maintaining compliance with the Payment Card Industry Data Security Standards (PCI DSS). Some payment processors provide their own payment gateways, while others, typically the larger processors, have reseller agreements with payment gateways.

Card network. Also referred to as the “credit card network” or “credit card brand.” This is the brand of the customer’s credit card, such as American Express, Visa, Mastercard, or Discover. The credit card networks are responsible for setting interchange and assessment fees, as well as the standards for PCI DSS.

Issuing bank. Also referred to as the “cardholder’s bank” or “consumer bank.” This is the bank that provides the customer with their credit card. One of the primary functions the issuing bank serves in the credit card processing cycle is to determine whether the cardholder’s account holds the funds to complete a transaction, and to release those funds for settlement.

Acquiring bank. Also referred to as the “merchant bank.” This is the bank used by the merchant to hold their business funds and receive money from transactions. It can provide the merchant with card readers and equipment to accept card payments. The acquiring bank can also serve as a credit card processor.

* Please note that “merchant bank” and “merchant bank account” should not be confused with the similarly named “merchant account.” A merchant account, typically created by a merchant services provider, is an account that temporarily holds the funds from processed credit card (and debit card) purchases. As the merchant, you do not have direct access to this merchant account—it is simply a holding account for these funds, which are transferred to your business banking account once the settlement process completes.

How credit card processing works

- Credit card processing starts at the consumer level: the customer initiates a payment with their credit card, and the payment information is shared with the merchant.

- The merchant accepts and collects the payment information, in one of two ways: a.) in person as a “card-present” transaction or b.) online or via telephone as a “card-not-present” transaction.

- Next, the payment information is sent to the credit card processor, who sends it to the card network.

- The card network then passes the payment information to the consumer (issuing) bank.

- The consumer bank is responsible for verifying that the cardholder has sufficient funds or credit to complete the transaction. The bank may also run security protocols to ensure the purchase is legitimate. It then approves or declines the transaction, and communicates that decision through the credit card processor. The three most common reasons for a declined transaction are a.) insufficient funds; b.) credit limit reached; c.) unauthorized purchase (e.g. if the card has been reported lost or stolen).

- If the transaction passes the consumer bank’s verification processes, the funds are released from the consumer bank to the merchant account, and subsequently enter the settlement process (see step 8).

- Meanwhile, the notification travels back from the consumer bank to the point of origin of the sale, and typically results in a message on the card reader or the virtual terminal that tells the merchant whether the transaction has been “approved” or “declined.”

- The final step in the process is settlement, which can take several days depending on the card network involved in the transaction. Settlement is the official transfer of the transaction amount from the consumer bank to the merchant bank, less applicable processing fees.

What you need to know about bank deposits

As described above, assuming a transaction is approved, the funds are transferred from the cardholder’s bank to the merchant account. Once settlement completes, they’re sent to the merchant bank account. Depending on your payment processing terms and the frequency with which fees and other charges are deducted, the amount of the sale or transaction may not reflect the amount of the actual bank deposit.

To learn more about bank deposits, check out our guide.