Expand your business with Clover Capital

Clover Capital allows merchants, like Chateau 4 Paws, access to funds to purchase equipment, hire more staff, or use for anything they need to grow their business without the hassle of paperwork and confusing re-payment methods.

The challenge

Russell has a successful pet grooming business and wants to grow, but not with all the strings that come attached with investments and bank loans.

The solution

Clover Capital integrates right into her Clover POS, so she can access a rolling line of capital whenever she needs it.

The result

Thanks to Clover Capital, Russell can take her business to the next level–and even treat her employees to a staff outing.

Clover Capital helps groom Chateau 4 Paws for success

Janelle Russell, owner of Georgia-based pet grooming salon, Chateau 4 Paws, had been using Clover for several years. Business was going well, up until the COVID-19 pandemic hit. Then her business doubled. “Everybody was home, you know. Nobody wanted to smell their dog,” she shares, laughing. “Customers had me so booked and so slammed through the whole two years, that I had to hire more people to make sure we could continue to provide the services we have always provided.”

Russell also found herself in need of more inventory and supplies, but she didn’t want to put it on a credit card, and she didn’t have access to outside investment capital.

Her Clover business consultant mentioned Clover Capital. “Based on your transactions, we can offer you $8,000 and you don't have to make payments directly to us,” he explained. “We'll pull out a percentage each day when you close out.”

Intrigued, Russell decided to give Clover Capital a try. The amount of each Clover Capital repayment scales up or down based on Russell’s daily sales (after tips).

If I did not have the Clover Capital, I would use my credit card, something I want to avoid,” Russell explains. “I’m in a better place because of Clover Capital, it allows me to use that cash flow to grow my business.”

Janelle Russell

Chateau 4 Paws

chateau4paws.com

Fayetteville, GA

Dog grooming salon

Clover Merchant Since: August 2016

Since Clover processes all her transactions, it automatically takes out 15 percent for Clover Capital repayment before sending her the proceeds of each day’s sales. “I'm not stressed paying it back because it's automatically taken out,” she says.

Russell had tried other funding instruments before–she had taken out a SBA (Small Business Administration) loan to buy a mobile grooming van, and managed to secure a small PPP (Paycheck Protection Program) loan as well. But unlike loans, she learned, Clover Capital doesn’t require mountains of paperwork. Clover can see her past sales, so funds are approved based on that information.

Russell has grown to appreciate Clover Capital so much that she has used it continuously for about the past five years. It has allowed her to buy inventory, pay for advertising, add a fence on the side of her building, and treat her six employees to monthly outings. These outings are based on staff suggestions and have included trips to Dave and Buster’s and Applebee’s. She says it allows them to let their hair down and get to know each other outside the workplace.

More importantly, Clover Capital enables Russell to fund the business on a consistent basis rather than applying for one-off cash infusions.

Russell also appreciates the detailed reports she receives every morning that show how much money she brought in from sales and tips, and how much Clover has deducted for processing fees, and Clover Capital interest and repayments. Her tax advisor appreciates the detailed reports, too. As she considers opening a second location, she says she’ll definitely continue using her favorite POS system. “I’m never leaving Clover, I just love it.”

Want to purchase a device with Clover?

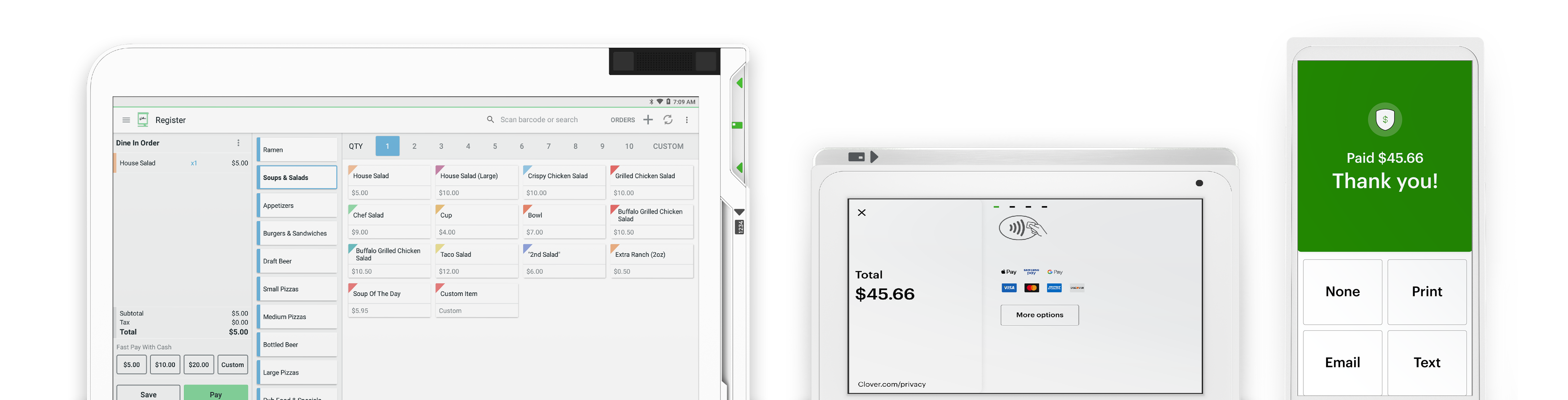

It’s never been easier. Set up your Clover POS system with the right mix of devices and apps for your business. Add more devices or apps when you’re ready.