Whether you’re about to start using merchant services for your business for the first time, or you’re looking to upgrade or switch, knowing what to look for and what to expect can make all the difference. Use this guide to learn about merchant services and how to leverage them for your business.

In this guide:

- What are merchant services?

- What is a merchant account?

- What merchant services can do for your business

- The costs of merchant services

- Choosing a merchant services provider

What are merchant services?

The basics of merchant services

The term "merchant services” refers, first and foremost, to the various services and equipment businesses rely on to accept and process payments from their customers via credit cards, debit cards, and electronic payment methods. These services are typically provided by banks, credit card companies, point-of-sale manufacturers, and other businesses. Examples of merchant services include:

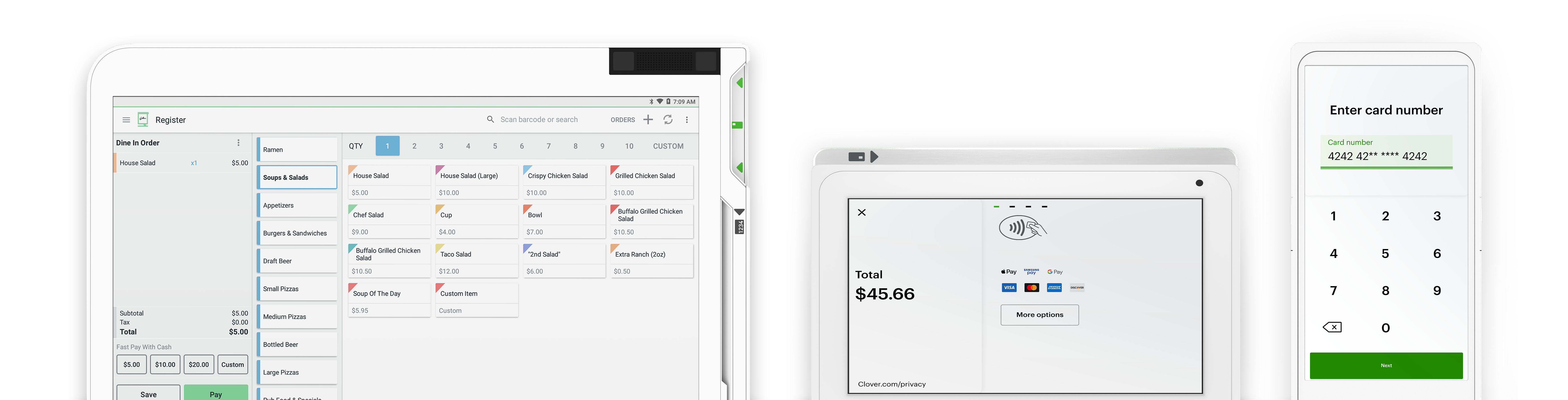

- Point-of-sale (POS) systems – equipment used to take customer payments

- Payment card readers – devices used to accept chip, swipe, or contactless cards

- Software or apps for business management – software that helps manage orders, inventory, employees, customers, and other aspects of the business

- Online payment gateways – software that allows a business to take payments online

- eCommerce platforms and services – software used to set up and run an online store

- Cash advances and business loans – financing services that provide access to money

- Gift card, loyalty, and other promotional programs – marketing tools that engage customers for new or repeat business

What are merchant services providers?

Merchant services providers are third-party organizations that serve as intermediaries between businesses and the banks or financial institutions that process payments. While they primarily provide credit card processing services, merchant services providers are increasingly expanding into other areas that are related to or enhance the transaction experience, such as gift cards and loyalty programs, as well as business operations in general, such as managing inventory and providing business insights through reports.

Types of merchant services providers include:

- Banks

- Independent Sales Organizations (ISOs)

- Point-of-Sale (POS) system providers

- Payment gateway providers

What is a merchant account (and why do you need one)?

A merchant account is a special type of bank account that allows your business to securely process card-based sales and electronic payments. It’s the holding account for funds before they are cleared for transfer to your organization’s bank account. Although there are many ways to obtain a merchant account, most businesses apply for one through their merchant services provider or payment processor.

What merchant services can do for your business

Merchant services serve a dual primary purpose: a.) enable your business to take credit and debit card payments; and b.) ensure that customer card transactions are secure and efficient.

The journey that a sale takes before the funds arrive in your business bank account starts at the point of sale, when your customer makes a payment via a credit card, debit card, or other methods such as contactless payment. The payment processor steps in at this point, managing the movement of the transaction data and ensuring all the right dots are connected throughout the journey so that the transaction goes through smoothly and securely.

The importance of scalability and flexibility

As mentioned in an earlier section, merchant services providers are evolving beyond their original purpose of processing credit and debit card payments—some are going as far as providing fully-fledged point-of-sale systems. These systems offer much more than just payment processing; you can now track your inventory, run reports, manage employees and their schedules, and reconcile tips and commissions.

The additional capabilities of merchant services allows merchants to worry less about the processing of payments and focus on running and growing their business. This makes sense—in a constantly evolving marketplace, merchant services providers should not only know what your business needs now, but also what it’s likely to need in the future. As your business grows and changes, your merchant services providers should be flexible enough to adapt. For example, you might start with a simple card reader to start accepting credit and debit cards and expand to a full point-of-sale system that includes multiple devices to take mobile wallets (e.g., Apple Pay®, Google Pay™, etc.), contactless payments, and eCommerce transactions. You can add additional accessories such as printers, cash drawers, scanners, and even hardware to take payments with your mobile device.

As the possibilities multiply, it becomes even more important for you to consider the different factors and make the right choices for your business. (More on this in Choosing a merchant services provider).

The costs of merchant services

As with any other business service, merchant services come with a cost, typically structured as follows:

- Monthly or annual service fees

- Per-transaction rates

Because merchant services fee structures can be a bit opaque, it’s important to take the time to understand the most common costs.

What are merchant services fees and rates?

The first step in ensuring merchant services actively support your business, rather than strain your bank account with excessive fees, is to gain a basic understanding of how credit card processing works and the rates and fees associated with it.

The three common types of pricing models merchant services providers employ are flat-rate, tiered, and interchange-plus.

Flat rate. The processor charges a simple fixed fee for all credit and debit card transactions regardless of the card used for payment. This can be structured as a simple base rate (for example, 2.9%), or a base rate plus a small per-transaction amount (for example, 2.9% + $0.30 per transaction).

Tiered. The processor charges a fee based on the card type used in the transaction, how much risk is associated with the transaction, and the overall transaction volume of the business. This model is considered the most complex and potentially most confusing to merchants.

Interchange Plus. Considered the most transparent, the Interchange Plus is also the most common pricing model. Here, the merchant is charged a percentage of the transaction (the interchange rate) plus a fixed per-transaction fee.

No matter which pricing model your business selects, note that not all transactions clear at the same rate. A qualified transaction will process at a lower rate than a non-qualified transaction.

In addition to the base pricing models, merchant services often include miscellaneous fees. It’s important to be aware of these fees, as they can often be negotiated; at the very least, they should not exceed standard rates for the industry.

Fees that should stay within industry levels:

- Monthly service fee

- AmEx transaction fee

- PCI compliance fee

Fees that experts say should be waived:

- Application fees

- Monthly minimum penalty fees

- Statement fees

Choosing a merchant services provider

When choosing a merchant services provider, think about what your business needs now and what it might need in the future. Ask the right questions, research, compare, and don’t be afraid to negotiate. Not all merchant services providers are created equal.

What to consider when choosing a merchant services provider?

When considering merchant service providers, look for more than low rates. Look for merchant services providers that can help you run your operation, grow your business, and are transparent about their pricing structures. Here are some questions to ask when considering a merchant services provider:

- Do they provide the software, hardware, and services I need to run my business?

- Are the rates and fees transparent and easy to understand?

- Is the customer support responsive and easy to reach?

- Is there protection against credit card fraud?

- What other services will I need if I decide to grow my business?

The importance of customer support

Good merchant services providers have responsive and readily available customer support. Make sure that the customer support package includes real, knowledgeable people who can answer your questions. At Clover, we take customer support seriously. We provide 24x7 support for all of our U.S. merchants, along with multiple levels of support service.

Credit card fraud protection and security

When it comes to the security of your payment processing systems, you want to make sure your business—and your customers—are covered. Look for:

- Systems that support PCI compliance to help protect you and your customers. To learn more about what it means to be PCI compliant, read our PCI Compliance guide.

- The option to request the security code (CVV, or “Card Verification Value”) on your customers’ credit cards, as well as their zip code.

- Insurance to cover worst-case scenarios.

- Control over how much access your employees have to your POS systems.

Additional services to consider

Don’t forget to ask the merchant services providers you’re considering what other services they provide and how those services can potentially benefit your business now and in the future. Clover, for example, provides a number of business services on top of our payment processing, including cash advances, employee management, and customer engagement and loyalty programs.

Other additional services you might want to consider include:

- Financing options, such as credit lines and business loans

- Employee and payroll solutions

- Small business banking services

- Business management app integrations

Disclaimer: This guide is for informational purposes only.